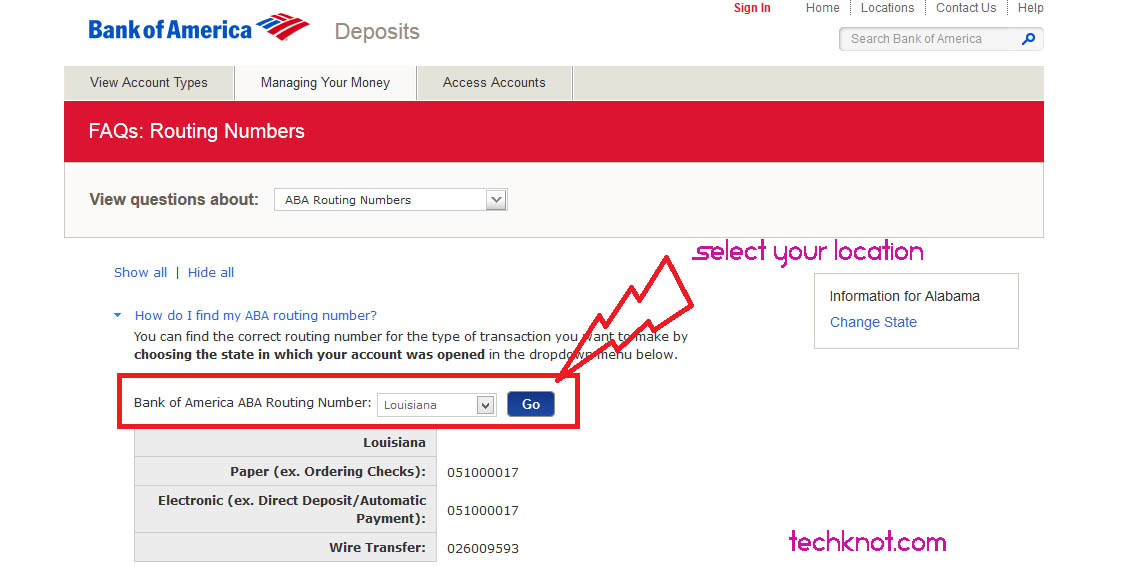

For international wire transfers, you’ll also need a SWIFT code.We are an independent, advertising-supported comparison service. For inbound or outbound domestic wire transfers and ACH transactions, you’ll need the nine-digit routing number that identifies a bank or other financial institution in the U.S. What is the difference between electronic and wire routing numbers?īoth electronic payment options use routing numbers.

For recurring or regular payments and credits where you want to avoid fees, and transactions don’t necessarily need to be completed same-day, ACH may be preferable. They are both safe and convenient electronic payment solutions! If you’re looking for a fast, one-off transaction and are comfortable paying a higher fee, a wire transfer may be your choice. What is the difference between ACH and wire transfer? Funds wired internationally may take up to a few business days. Funds sent via wire transfer domestically can be completed in minutes to hours, if processed prior to the daily cutoff time. Transaction speed is one reason to choose wire transfer vs electronic transfer. Is wire transfer safe?īecause the bank and non-bank entities that handle wire transfers are governed by regulatory authorities, wire transfers are considered a secure way to transfer funds. Once a wire transfer transaction is complete, it cannot be reversed. The payment is then deducted from the payor’s account, along with a wire transfer fee. The payor simply provides their bank or money transfer company with the amount to be wired the account number from which the funds will be drawn the name, address, and phone number of the recipient and the account number and bank routing number for the recipient. This brings us to a common question: is direct deposit a wire transfer? The answer is no, direct deposits are a type of EFT. The most common types of wire transfer include sending money from one bank to another bank or sending money via a non-bank institution like a money transfer operator. A wire transfer is a transaction between banks that moves funds from one account to another through a secure messaging system. The best way to describe the difference between electronic and wire transfer is that wire transfer is a type of electronic fund transfer. Processed transactions are sent to the receiving bank, which makes the required payments from or deposits to each receiver’s account. The clearing house receives transaction requests in bulk and processes them in batches.

It works like this: one bank initiates a transfer which is then sent to the ACH operator. The ACH is an electronic network that serves as the primary method for financial institutions, businesses, and individuals to send or receive funds. What is an Automated Clearing House (ACH)? This is primarily because ACH payments are not processed in real time they are processed in batches, and multiple parties are involved. International EFTs or those that involve large sums of money may require additional time. The exact timing can vary, but most EFT payments clear in 1-3 business days domestically. It’s a batch processing system that moves money by either pushing funds out of the originator’s account or pulling funds from the receiver’s account. The ACH aggregates transactions for processing from one bank or financial institution to another. Most EFTs are processed through an Automated Clearing House (ACH). Many electronic payments fall under the EFT umbrella, but the most common types of EFT transactions include ATM transactions, eChecks, point of sale (POS) transactions, direct deposits for payroll, business-to-business (B2B) payments, online bill pay, and wire transfers. In a nutshell, electronic fund transfers (EFTs) involve the electronic transfer of money from one bank account to another bank account. But as the adoption of digital payments becomes more widespread, and the volume of paper checks continues to decline, there is still some confusion over exactly what is electronic fund transfer (EFT) and, more specifically, what’s the difference between electronic and wire transfer. Digital solutions are rapidly gaining momentum within the scope of business payment strategies today, thanks to several clear advantages including speed, efficiency, and security.

0 kommentar(er)

0 kommentar(er)